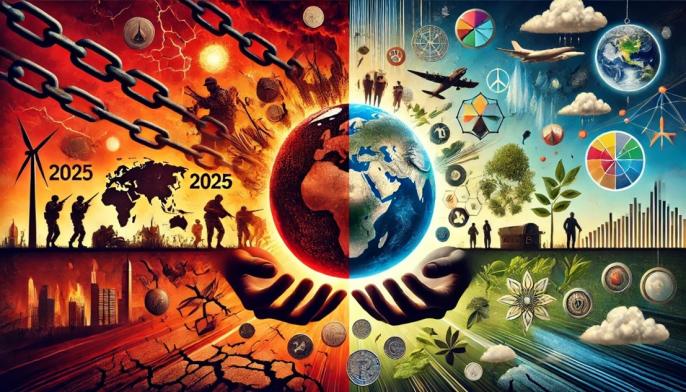

2025 – A year of upheaval?

7th January 2025

As 2025 has begun, businesses and asset managers are bracing for continued geopolitical uncertainty, with significant concerns about U.S.-China relations, global instability, and rising protectionism. Events like the collapse of the French government, the fall of Syria’s Bashar al-Assad, and martial law in South Korea exemplify global turmoil. Business leaders questioned by the Diligent Institute and Corporate Board Member, which provide corporate leadership training, rank geopolitical conflict as a top risk, with 52% fearing it could lead to the next major global disruption.

The following scenarios represent various upside and downside political risks for this year and make clear that the possible range of geopolitical developments is very broad, implying large potential swings in financial markets.

Upside Scenarios in Geopolitics:

Resolution of the Ukraine Conflict:

- Scenario: A negotiated peace agreement is reached between Ukraine and Russia, supported by the United Nations and key powers. Sanctions on Russia are partially lifted, and reconstruction efforts in Ukraine begin with global cooperation.

- Implications: Reduced energy price volatility, improved European security, and a boost in investor confidence in Eastern Europe.

U.S.-China Relations Improve:

- Scenario: Diplomatic breakthroughs reduce tensions in trade and technology disputes. A framework for economic cooperation and joint climate initiatives is established.

Implications: Global trade and investment flows will be lifted, especially in the Asia-Pacific region. Sectors dependent on semiconductor supply chains and global logistics thrive.

Middle East Stabilization:

- Scenario: Saudi Arabia, Iran, Israel and other key players agree on measures to stabilize the region, leading to reduced conflict in the Palestinian territories and Yemen and more cooperative oil production policies.

- Implications: Energy markets stabilize, and investment opportunities in infrastructure across the Middle East expand.

Global Climate Diplomacy Success:

- Scenario: Major powers reach consensus on a comprehensive climate policy at the UN Climate Summit, with binding agreements on emissions reductions, green technology transfer, and climate finance.

- Implications: Accelerated global transition to green energy, lower carbon emissions, and robust growth in renewable energy sectors.

Downside Scenarios in Geopolitics:

Escalation of the Ukraine-Russia Conflict:

- Scenario: The conflict expands, involving NATO directly through border skirmishes or cyberattacks. Russia cuts off energy supplies to Europe entirely, while NATO countries impose broader sanctions.

- Implications: Severe disruptions to global energy and food markets, skyrocketing inflation, and increased defense spending at the cost of social programs.

U.S.-China Cold War Intensifies:

- Scenario: Taiwan becomes a flashpoint, with increased military posturing and economic decoupling. China imposes sanctions on U.S. tech firms, and the U.S. further restricts Chinese access to advanced semiconductors.

- Implications: Major disruptions in global supply chains, heightened market volatility, and slower global economic growth. Increased risk of regional conflicts in East Asia.

Middle East Oil Supply Shock:

- Scenario: Renewed conflict between Iran and Israel, or a collapse of the Saudi-Iran détente, disrupts oil exports from the region. Terrorist attacks on critical infrastructure exacerbate the crisis.

- Implications: Sharp spikes in oil prices, increased inflationary pressures globally, and potential recession in oil-importing nations.

Global Fragmentation and Rise of Regional Powers:

- Scenario: Multilateral institutions (e.g., WTO, UN) weaken even further as regional alliances like BRICS and AUKUS dominate global policymaking. Trade becomes fragmented, and smaller nations are caught between power blocs.

- Implications: Reduced global cooperation on critical issues like climate change, pandemics, and economic inequality. Heightened risk of localized conflicts and trade disruptions.

Cybersecurity Crisis:

- Scenario: A major state-sponsored cyberattack cripples critical infrastructure (e.g., energy grids, financial systems) in a major economy, triggering retaliatory strikes and prolonged instability.

- Implications: Massive economic losses, shaken investor confidence, and increased military focus on cybersecurity at the expense of conventional capabilities.

The geopolitical landscape in 2025 will be shaped by competition among major powers, regional instability, and global issues like climate change and cybersecurity. Policymakers and investors should prepare for these contingencies by diversifying risk. In our Global Political Analysis publications we will keep close tabs on the issues mentioned above and we will help our clients navigate these choppy political and economic waves.