Research on asset allocation, financial markets, geopolitical risks, FX & Interest Rates

Don't let information overload slow you down; we have the research solution to maximize your time and resources.

Every week, we invest 200 hours in assessing the different arguments and scenarios put forward by the most respected research houses in the world to present you the most likely medium-term outlook for the major markets in just a 20-minute read.

Testdrive our research now by exploring all 11 research areas below and unlock the full potential of your invaluable time.

Our research

Eddy's Weekly Market Insight

Thursday, 12 March 2026

Recent publications

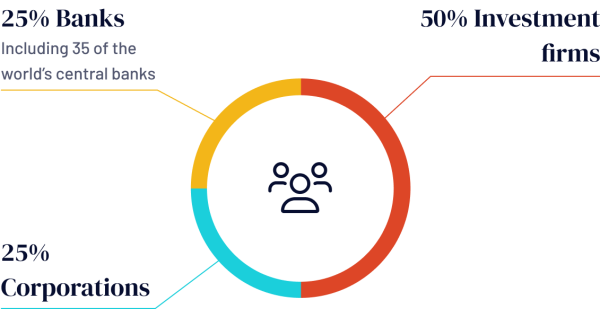

These organisations rely on our research

Corporates

Investment

Banks

Insurance

Our clients

Trusted by 3500+ professionals globally

Like you, most of our clients were sceptical at first. That’s no problem, we understand.

Just give us a chance to win you over. Good chance we will be partnering for years!

Why do professionals work with us?

- Clear Views

Crystal-clear, thought-provoking - without the jargon. We analyse the most relevant arguments for the financial markets, weigh them & discuss most likely scenarios. The result: a clear, mid-term view of the consequences for the major financial markets.

- Independent

ECR is privately owned and strictly independent. We have no investment or trading activities. Our sole aim is to deliver clear and outspoken views, enabling you to make decisions with the best information available

- Time saving

Every week, our team invests 200+ hours reviewing over 100 of the world’s top research sources. We distill this into concise analyses you can absorb in just 20 minutes—so you stay ahead without the noise.